what is fit tax on paycheck

Fit stands for Federal Income Tax Withheld. The amount of income tax your employer withholds from your.

Reading Paystubs Where S The Magi Ripin

The amount of FIT withholding will vary from employee to employee.

. How It Works. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. 10 12 22 24 32 35 and 37.

Your bracket depends on your taxable income and filing status. Your total bonuses for the year get taxed at a 22 flat rate if theyre under 1 million. Coding help visual basics.

The employee is responsible for. Fit is the amount required by law for employers to withhold from wages to pay taxes. Real median household income adjusted for inflation in 2021 was 70784.

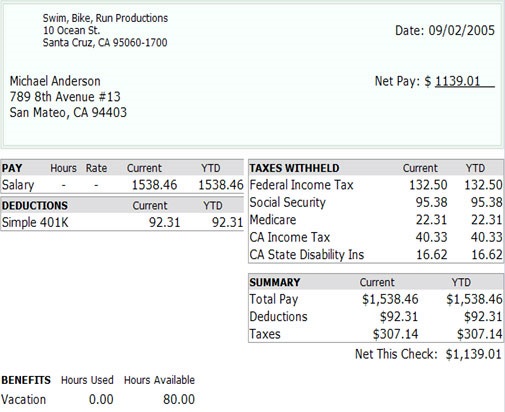

-federal income tax rate at 22 -state income tax rate at 9 -FICA rate at 76. With this information you can prepare for tax season. The amount of federal income tax.

What percentage is fit tax. Your net income gets calculated. Currently has seven federal income tax brackets with rates of 10 12 22 24 32 35 and 37.

Federal income tax rates range from 10 up to a top marginal rate of 37. The tax rates for 2020 are. All wages salaries cash gifts from employers business income tips gambling.

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. The federal income tax is a pay-as-you-go tax. Federal Paycheck Quick Facts.

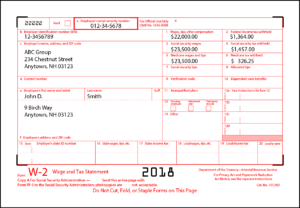

W-2 employees are workers that get W-2 tax forms from their employers. There are two federal income tax withholding methods for use in 2021. FICA taxes consist of Social Security and Medicare taxes.

There are seven federal income tax rates in 2022. You should calculate an employees federal income tax withholding with their Form W-4. The amount of income you earn.

See how your refund take-home pay or tax due are affected by withholding amount. What is the fit tax rate for 2020. However they dont include all taxes related to payroll.

If youre one of the lucky few to. Its important to remember that moving up into a higher tax bracket does not mean that all of your income will. Estimate your federal income tax withholding.

Use this tool to. Create decimal constants to hold the. These are the rates for.

Taxpayers pay the tax as they earn or receive income during the year. There are seven federal tax brackets for the 2022 tax year. These forms report the annual salary paid during a specific tax.

If your total bonuses are higher than 1 million the first 1 million gets taxed at 22. The federal income tax rates remain unchanged for the 2020 and 2021 tax years. FICA taxes are commonly called the payroll tax.

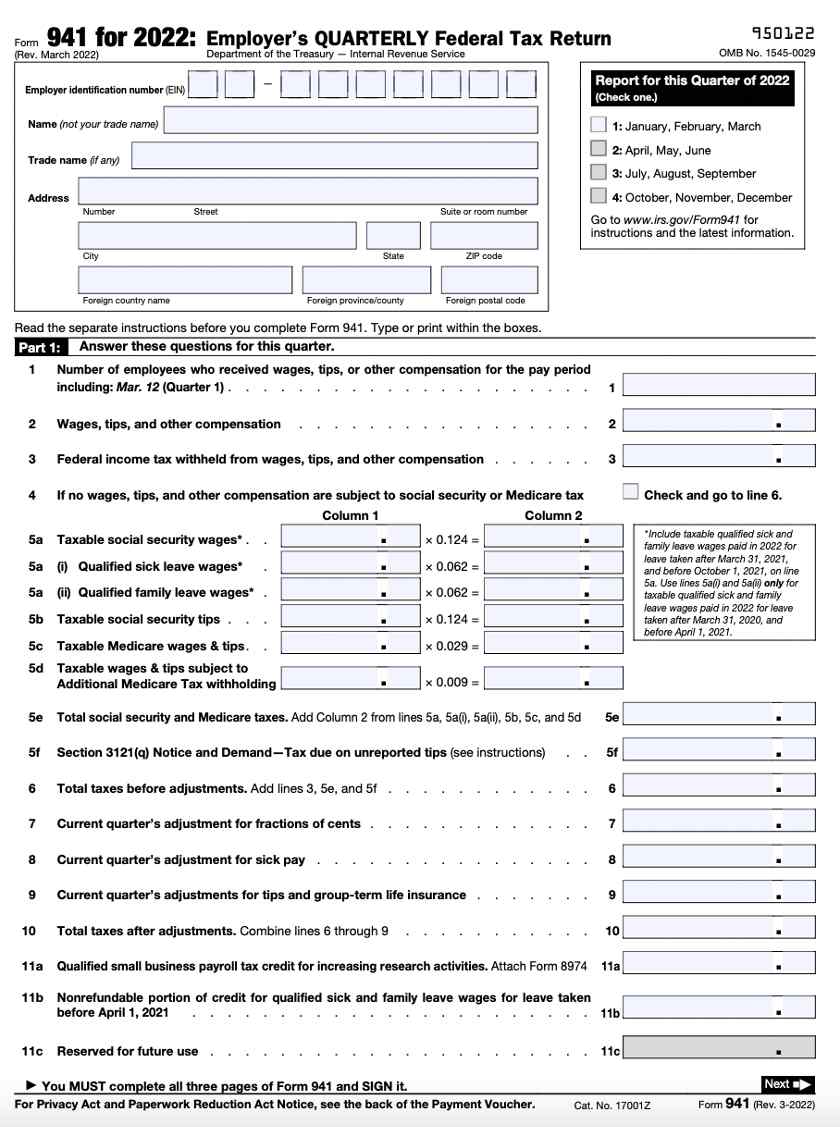

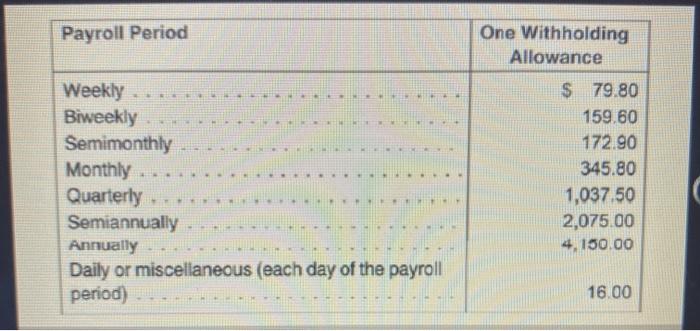

Wage bracket method and percentage method. The federal income tax has seven tax rates for 2020. 10 12 22 24 32 35 and 37.

It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. Whether you are single a head of household married. It depends on.

For employees withholding is the amount of federal income tax withheld from your paycheck. The federal income tax is a tax on annual earnings for individuals businesses and other legal entities. Taxpayers can avoid a surprise at tax time by checking their.

Federal Income Tax. 10 12 22 24 32 35 and 37. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate.

10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Who Owns Your Paycheck Life And My Finances

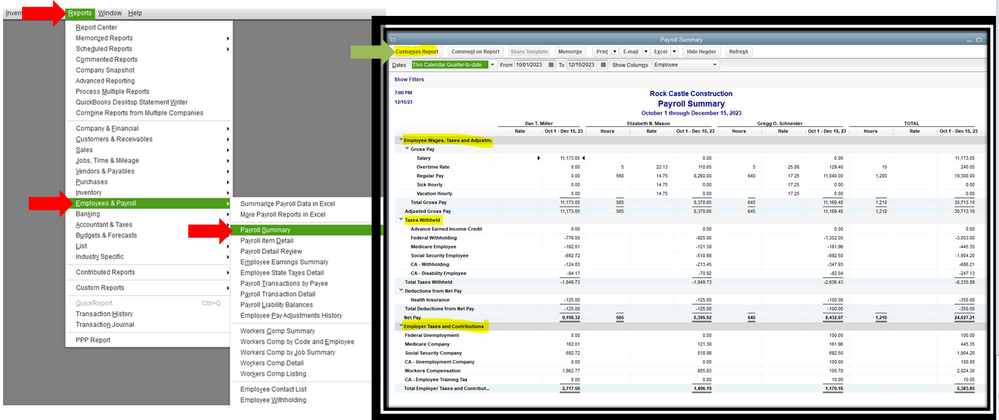

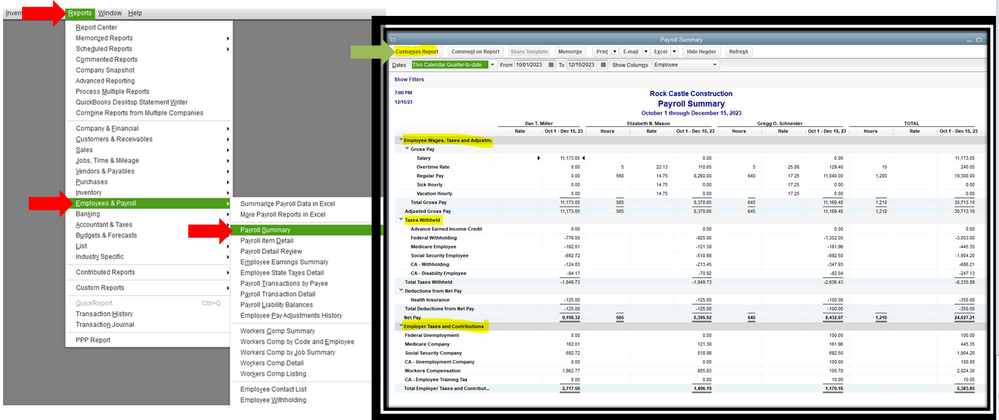

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

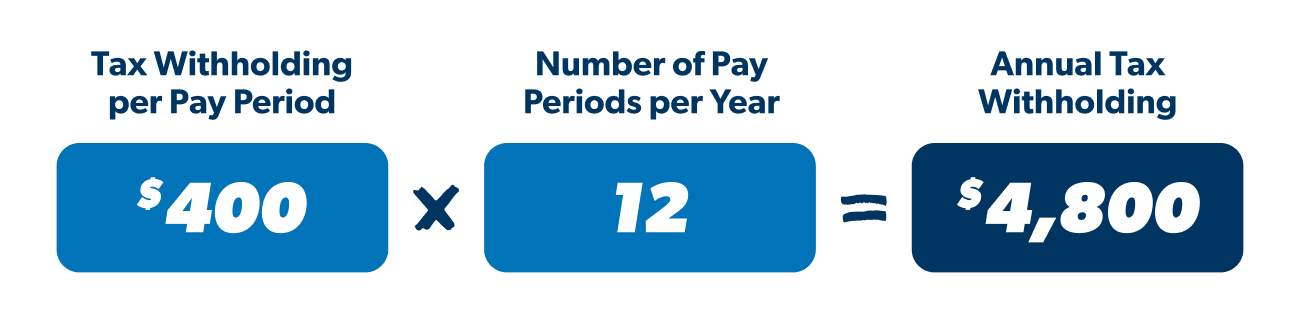

How To Calculate Your Tax Withholding Ramsey

Solved Federal Taxes Not Deducted Correctly

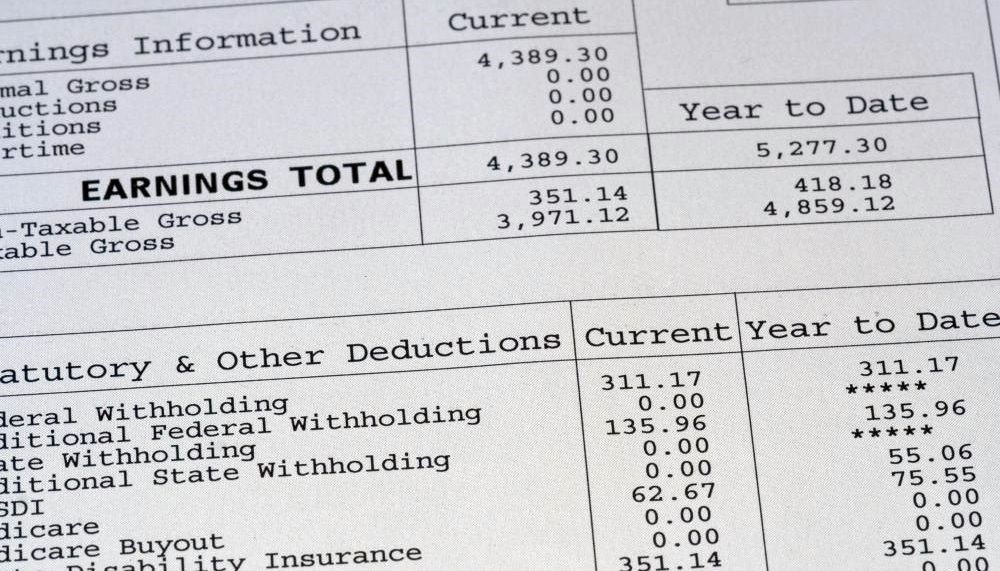

Understanding Your Paycheck Taxes Withholdings More Supermoney

How To Fill Out Form W 4 In 2022 Adjusting Your Paycheck Tax Withholding

Processing The Final Paycheck For A Deceased Employee Checkmatehcm

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

Federal Income Tax Fit Payroll Tax Calculation Youtube

12 Payroll Forms Employers Need

Solved Larren Buffett Is Concerned After Receiving Her Chegg Com

Types Of Taxes The 3 Basic Tax Types Tax Foundation

Taxable Wage Definition For Social Security Taxes

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Understanding Your Paycheck Taxes Withholdings More Supermoney

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate